Bulls have been suffocating the last 16+ months, as Bitcoin Bears have held a firm tracheal grip. The bulls experienced a series of false starts throughout 2014, with none of the news based pumps materializing, and all going the way of “the Microsoft, PayPal and Lunar pumps”. While this phenomenon can be attributed to a number of variables (that’s for another blog post), the bottom line that became apparent is that something significant was going to have to change in order to induce hyperbitcoinization. Moving into 2015, we saw what looked like a capitulation moment in January, but with a nominal amount of follow through price wise so far.

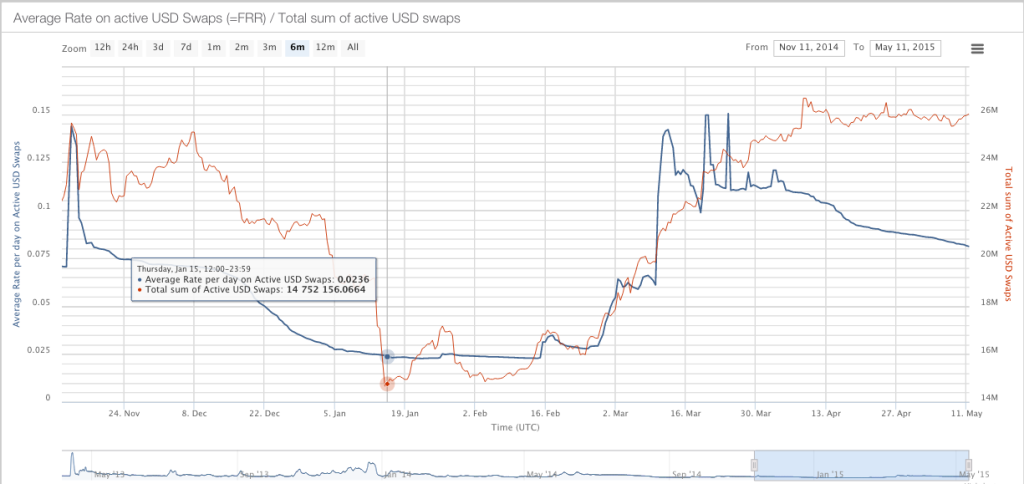

Taking a quick look at the USD swaps on BFX, we see that even during this capitulation, there were close to $15 million in USD longs that were not margin called. These traders are probably not BFX Dreamers, and are using margin safely, so we would expect them to be strong hands that are going to hold their long until they are more comfortable selling at a higher price. Yes, USD swaps have increased since January, but an important metric to look at is the approximately $11 million USD increase in swaps, not just the sum of swaps. It’s important to note, most of these swaps were opened starting in the beginning of March, which would infer they were used to purchase coin at prices higher than where we are now. These longs have been juicy bull meat for the bears recently, and we have been expecting a massive bear raid for a few weeks now.

Our long term outlook has always been extremely bullish, and now we are officially changing our short-medium term view to cloudy, with a chance of bullishness. This past weekend brought a few dollars of price movement, but perhaps the most significant indicator of our direction moving forward is what didn’t happen over the weekend.

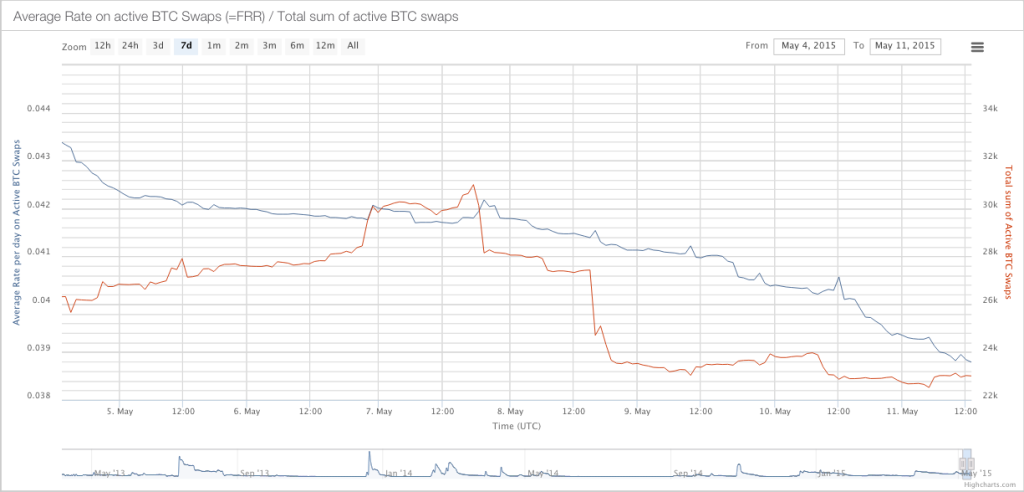

Last week, a significant number of shorts closed, presumably because of the bullish news in the Bitcoin ecosystem (GBTC, Goldman, Nasdaq). We see a slightly less than 1/3 decrease in BTC swaps over the last 7 days.

In the past, we have seen opportunistic bears use these time periods to drive down the price and accumulate more cheap coins. While it looks like some small dump attempts may have been made over the weekend, we do not see any significant increase in BTC swaps during this time period. That leads us to believe those coins were a) spot coins being sold or b) margin longs closing/trading.

In the past, we have seen opportunistic bears use these time periods to drive down the price and accumulate more cheap coins. While it looks like some small dump attempts may have been made over the weekend, we do not see any significant increase in BTC swaps during this time period. That leads us to believe those coins were a) spot coins being sold or b) margin longs closing/trading.

To be clear, we are not on the “bubble” train, as there has already been talk of bubbles in the interwebs. We believe that the path to 10k and higher will be a bumpy one, amplified by the derivatives and other instruments which have come to market since 2013. The bears will return and have their day to bask in glory again, but we are thinking that in the nearer term a small bull run may be in order.

And perhaps the most under appreciated Tweet of the weekend:

@jerrybrito THE blockchain. It's a colored coin implementation. That got lost on cutting room floor.

— Michael Casey (@mikejcasey) May 10, 2015