Sideways, to the right, more sideways. Traders looking for btc volatility since the days after the BFX hack have experienced just about as much pain as individuals following this year’s US election. It’s been a while since our last post, but the crypto space has been nothing short of drama free. The two biggest events to note in the preceding months have been: ETH fork/ETC inception and the BFX hack. While the ETH/ETC debacle is worthy of analyzing, the WSJ, Forbes and other publications have done a thorough job thus-far, and us covering this probably won’t happen until we can end the post with an actual obituary for ETH. The BFX hack is/was very newsworthy, but the lack of information being distributed by all involved parties allows for very little opportunity to study the attack without significant speculation.

If you haven’t given it a listen yet, it’s worthwhile to spent some time absorbing the latest Whaleclub Hangout from earlier this week, with Mike from BitGo.

As we’ve seen since it’s inception, the crypto space is never short of individuals daring to be innovative and creative. Periods of sideways bitcoin tend to lead to enhanced output from these individuals, and seemingly contribute to the notable altcoin pump and dump cycle. While the price of btc continues to increase in fiat terms, many individuals or institutions seeking to increase their hoard turn to alternative methods besides buy and hodl. With no shortage of opportunities to profit in the space, events like a 300%+ increase in the spot price of a shitcoin in 24 hours aren’t uncommon. The use of leverage and derivatives has become more prevalent and accepted, and these market moves are only amplified by the use of such instruments (as are traders profits and losses). Throw in an ever increasing number of exchanges globally, some of the more popular shitcoins being listed by these exchanges and ludicrous levels of fomo – we have ourselves a market Charles Ponzi himself would be jealous of. With pumps oftentimes sparked by “news” that isn’t really news, shitcoin markets are a playground for electronic trading and straight up rape of individual’s account balances who don’t understand all good things come to an end.

The history of crypto is littered with the corpses of pumps that became dumps, and bagholders are still kicking themselves for not identifying an opportunity early on and profiting. Most recently, Monero (XMR) became the king fomocoin, topping the shitcoin kingdom in both (possibly fake) volume and it’s presence in the news cycle. Launched on April 18, 2014, XMR flew under the radar of most traders for years, and was rarely mentioned outside of very niche parts of the already niche crypto space.

In August of this year, whispers of darknet markets considering the usage of XMR began to leak out. Hastily, speculators began to pile into XMR, which had been clearly accumulated at what would soon be rock bottom prices, for months.

One of the most fascinating aspects of analyzing the irrational behavior of traders/speculators (and soon to be bagholders), is that they rarely take the time to think critically through the fundamentals behind their latest self administered remedy for fomoitis. Monero may have certain properties which make it more ideal than other cryptocurrencies for darknet use, but is Pablo in South America going to PGP encrypt his XMR address and e-mail it to vendors in the dnm space to pay for their wares? Are exchanges where you can exchange XMR for other cryptos with decent liquidity terribly centralized? Are there any other real on/off ramps for XMR other than centralized services? After thinking through some seemingly obvious questions like these, any rational person would quickly realize that XMR is good for a quick pump and dump, and not a viable long term investment once the price left rock bottom (if ever). Without a self sustainable ecosystem, with a somewhat stable price, it is unrealistic to think that any anonymous crypto will gain enough traction to become an independent major player any time soon. The need for on and off ramps, limited adoption, small volume of transactions and dependence on centralized services are all factors which detract from the perceived anonymity these coins promise.

The usual early to mid-pump deluge of “news” began to hit the public, further compounding the irrational behavior of traders globally. “Credible” news site, The Merkle, published a piece that reads as if someone bought the local top. Bitcoin Magazine, produced a slightly more in depth read, but still didn’t cover all of the relevant aspects surrounding XMR’s integration into the darknet. Even Bloomberg covered the Monero phenomenon, reaching a wider and more diverse audience. The most realistic viewpoint on the situation was taken by Vice (Motherboard), which presented a fairly balanced article. From Vice:

For example, Vessenes wrote me in an email, the fact that there’s still only a relatively small number of Monero users means that any massive transaction will stick out like a sore thumb: there just won’t be many others of a similar size to mix with. That would defeat the coin’s promise of privacy, especially for drug vendors moving large amounts of product.

“If you think about moving say $2 million in a currency like this, you’re going to have a lot of trouble,” Vessenes wrote. “Monero works by sort of combining up your transaction volumes with other similarly sized transactions in round amounts—it’s going to be pretty hard to find people to do those large-scale moves with you.”

If Monero takes off on AlphaBay, it could create the critical mass needed to deliver on its own promises. It’s a bit of a self-fulfilling prophecy: widespread use on dark net markets might drive increased investment in and usage of Monero, thereby solving the privacy problem created by a relatively small pool of users.

This isn’t the first time a cryptocurrency promising better privacy than bitcoin has tried to break into the markets, making some users skeptical about the promise of Monero. Dash, a cryptocurrency that formerly went by the name Darkcoin, received substantial media attention when a few mid-sized markets implemented it in 2014. Two years later, Dash hasn’t been implemented on any online dark net markets worth noting.

“The switching cost from just using bitcoin to using Monero is going to be high, since not only is there a tech shift, a trust issue, there is also greater volatility,” Levin wrote. The $20 million overnight jump in Monero’s market cap, while potentially indicating increased usage and thus greater anonymity, also means that the currency’s value is highly volatile.

Realistically, there was never any chance Monero would rise overnight to become the flagship currency of the darknet market space. Of course though, this didn’t prevent the marketplaces themselves from aiding in the dis-information campaign to assist in pushing the price higher. Given the activities that the markets themselves facilitate, and the numerous questions surrounding the life and death of current and previous marketplaces, is it unexpected that there may be other factors at play here?

Alphabay posted on Reddit regarding their implementation of Monero, ending the post with:

We expect this to cause a spike in the price, so if you are an investor, now is the time to purchase Monero.

Well if that isn’t a telltale sign that “someone” has been accumulating, not sure which version of reality you’re living in.

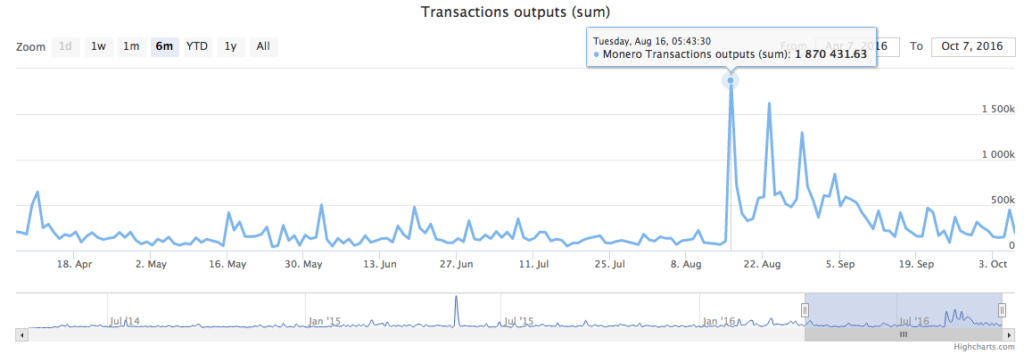

Observant Reddit users dug a little bit deeper, and noticed some unusual activity in the days preceding the Oasis announcement of XMR integration. This one chart just about sums it all up:

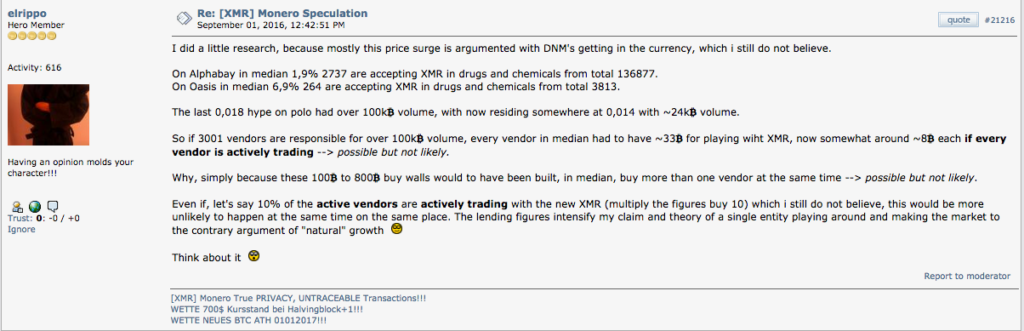

A quick browse through Bitcointalk topics discussing Monero, shows significant skepticism around the meteoric rise of the currency. There are the usual moonkids, but anyone with half a brain has trouble making sense of the parabolic rise in price. Multiple posters provide their insight, oftentimes leading to similar conclusions as this user:

I did a little research, because mostly this price surge is argumented with DNM’s getting in the currency, which i still do not believe.

On Alphabay in median 1,9% 2737 are accepting XMR in drugs and chemicals from total 136877.

On Oasis in median 6,9% 264 are accepting XMR in drugs and chemicals from total 3813.The last 0,018 hype on polo had over 100kBTC volume, with now residing somewhere at 0,014 with ~24kBTC volume.

So if 3001 vendors are responsible for over 100kBTC volume, every vendor in median had to have ~33BTC for playing wiht XMR, now somewhat around ~8BTC each if every vendor is actively trading –> possible but not likely.

Why, simply because these 100BTC to 800BTC buy walls would to have been built, in median, buy more than one vendor at the same time –> possible but not likely.

Even if, let’s say 10% of the active vendors are actively trading with the new XMR (multiply the figures buy 10) which i still do not believe, this would be more unlikely to happen at the same time on the same place. The lending figures intensify my claim and theory of a single entity playing around and making the market to the contrary argument of “natural” growth

Think about it

Screenshot as well:

A few short weeks, and many rekt accounts later, XMR has begun free-fall. Oasis apparently exit scammed, running with a minuscule amount of coin, estimated to be around150 btc worth of users drug money. Given the facts outline above, the most plausible scenario we can develop is:

- Darknet markets decide that they aren’t generating enough btc through their traditional illicit activities

- Market owners/insiders accumulate large amounts of XMR, and establish leveraged long positions

- News “leaks” that markets may be integrating XMR, initiating fomo stage 1

- Confirmation of XMR integration and instigation by markets themselves that traders buy XMR fuels fomo stage 2

- Traditional news sources cover the non-event, providing confirmation bias for soon to be bag holders

- Market owners/insiders dump their XMR, and walk with the profits

- Less than 7% of vendors on a small market place actually end up offering the option of accepting payment via XMR

- Bubble bursts, tears are generated. Too bad, so sad.

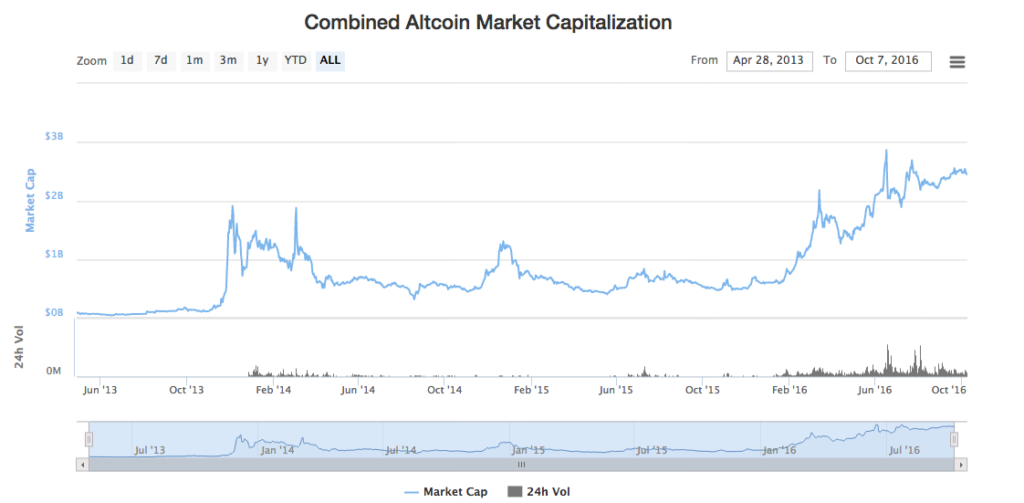

The global shitcoin market cap has been making lower highs, and appears to be rolling over. Monero may have just exit scammed the alt coin pump cycle, just in time for the next period of btc volatility.

Source: Coin Market Cap

What does all of this have to do with Rare Pepes? What the fuck is a Rare Pepe? How can I obtain as many as possible?

As exhibited time and time again in the cryptosphere, irrational exuberance is a cornerstone of the markets that we know and love. Oftentimes though, this severe overpricing of assets and bubble mentality is backed by very little other than hopes and dreams. The hot fomo shitcoin of today will be forgotten about weeks or months from now, as another speculative asset takes it’s place. An inherent risk with almost all of these portfolio “diversification” techniques, is that buyers/investors are taking on additional layers of unnecessary counterparty risk. As exhibited by the recent round of ETH attacks, many of these projects may contain flaws, any of which could lead to a disastrous outcome. What we have yet to see, is significant fomo surrounding projects or assets based on the bitcoin blockchain, secured by the hash power and nodes of the most secure network. Every time an exchange is hacked, everyone jumps on the “we need decentralized exchanges” (dex) train. Hello? There already is a fully functioning decentralized exchange, which has been blowing up right in front of you. The Counterparty protocol (XCP), which runs on top of the bitcoin blockchain, has been chugging away since 2014. Besides the fact XCP actually accomplishes what it promises, flawlessly, it’s native DEX has been picking up significant volume in recent weeks. BitGirls and Spells of Genesis are two contributing factors, which will only act as compounding components in any XCP fomo. We believe though, that the catalyst which will ignite this rocket is something that everyone can relate to: Pepe the frog.

Recently portrayed as a symbol of white supremacy, harmless Pepe has been providing us with lulz for years. Even Buzzfeed has even covered Pepe multiple times, and in an article which surprisingly isn’t titled “10 Things You Need To Know About The Market Value Of A Rare Pepe”, Rare Pepes and the idea of assessing what their market value may be are discussed.

To backtrack a step – a Rare Pepe is a meme. Pepes can be directed at any audience, from music, to sports, to politics and anywhere in-between. Most Pepes exist in the virtual or digital domain, although physical Pepes do exist. Like all rare items, there is an established market for Rare Pepes. Until recently though, there has been no actual method of verifying that your Pepe is actually rare. Although we have feelings of disdain for Buzzfeed and their social media feed polluting tactics, the article referenced above actually produces some insightful (although now invalidated) thoughts surrounding the possible market value of a Rare Pepe.

Quotes from the article:

To find out how an actual market value for a rare Pepe might work, I asked experts in the field of digital art.

Michael Connor, artistic director of Rhizome, a digital arts organization affiliated with the New Museum: “A piece of digital art can definitely be rare. Consider, for example, Constant Dullaart looking for images of the vacation photograph of Jennifer Knoll that was widely used as a Photoshop demo image. However, rarity is a complicated way to assign value to digital works.

“Unlike a Picasso painting, which has a kind of built-in rarity because each one is one of a kind, a digital artwork that has widely recognized value can only maintain its scarcity if it is lost or if it is protected in some kind of legalistic way. Owning digital art either means having the original files as well as certain kinds of legal rights to use it, or it might mean owning the only copy of something and hoarding it like Gollum.

“One very nice way that artists can protect the scarcity value of their work is by assigning it a specific URL. For example, there can be many copies of a particular .swf file, but in some sense there can be only one jellotime.com.”

Michael Duca, co-founder and CEO of NeonMob, a digital art sharing and trading site (think more like DeviantArt and less the Museum of Modern Art): “Ownership and viewability when it comes to digital art are two separate things. Ownership is who legally owns a particular work of digital art. Viewability is who has the ability to see it. Programmers can limit viewability with some tricks, but completely preventing people from sharing digital art is close to impossible. That doesn’t mean the underlying work has no value or that people won’t spend money to own it.

“In short, yes, it is possible to have a rare Pepe that is actually worth money. You’d want for the original work to be sold on a platform that recorded the buyer and allowed for future transactions of that digital work (e.g., via trade or resale). You would want to authenticate the work was original and ideally the artist would be the one selling the work. You would have to be OK with assuming the image would be shared more widely. But still, just like software or physical goods there would be one or more owners, depending on the number of authentic, original prints sold, and they would have a finite scarcity corresponding to some monetary value, which is determined by the market demand for that print.”

Magdalena Sawon, owner and director of the Postmasters Gallery in NYC, which specializes in new media and net artists: “Selling memes, GIFs, and other internet-based material is complicated and at this point frankly next to nonexistent because if the work itself belongs and functions exclusively online; it is counter to its nature to have it removed from that ‘habitat’. And if you do not, what exactly does the ownership mean?

Well, guess what? On September 9th, 2016 at 01:46:42 (UTC), history was made. Verifiable on the blockchain, all this talk from supposedly creative people (above, from Buzzfeed) was invalidated. The first Rare Pepe, in virtual/digital form, with an integrated, transferable, immutable certificate of authenticity, was created.

This seemingly small and still mostly unnoticed development, may end up being one of the most significant public facing aspects of real life integration the Counterparty project has seen to date. Following in the footsteps of Satoshi, the figure depicted on the very first Rare Pepe, an anonymous bitcoiner produced the first Pepe which is verifiable as rare, transferable, immutable and scarce. In addition, the Counterparty DEX is an extraordinarily easy to use venue where Rare Pepe traders can establish a mutually agreed upon value for each Rare Pepe card, priced in XCP under free market conditions.

In response to the statements that “experts” in the field of digital art made to Buzzfeed:

However, rarity is a complicated way to assign value to digital works.

“Unlike a Picasso painting, which has a kind of built-in rarity because each one is one of a kind, a digital artwork that has widely recognized value can only maintain its scarcity if it is lost or if it is protected in some kind of legalistic way. Owning digital art either means having the original files as well as certain kinds of legal rights to use it, or it might mean owning the only copy of something and hoarding it like Gollum.

Rarity WAS a complicated way to assign value to digital works. Until the advent of the Counterparty protocol. Able to be traced easily, Counterparty tokens act as a digital and transferable certificate of authenticity for any piece of artwork, collectable or essentially any physical or digital object imaginable. Hell, you can even make a token that says “my shit” and sell it to others if there’s a market.

How can this be extrapolated to the “real life” rare art world? Let’s say I own a Picasso, or any other piece of art which has “built-in rarity”. A Counterparty token can be generated representing ownership of that piece of artwork. Along with the physical art itself, then token can then be transferred to a buyer as proof of ownership. Unlike a paper certificate, ownership of this token can be tracked via the blockchain to show all previous sales/owners, and that history can not be changed. Rare art can always, and is sometimes counterfeited, but techniques such as radiocarbon dating can easily be employed as they are today to verify authenticity.

“One very nice way that artists can protect the scarcity value of their work is by assigning it a specific URL. For example, there can be many copies of a particular .swf file, but in some sense there can be only one jellotime.com.”

Sure, this sounds ideal in theory. But why take a risk with a simple URL when advanced cryptography methods can be employed? There can be many copies of an image file, but not of a Counterparty token unless specified during creation. Once created, the token can be locked to prevent further issuance. Taking this one step further, into the digital realm – if an artist generates a digital piece of art, a hash (let’s just say md5 for sake of argument) can be generated from the digital file of that completed piece of artwork. The hash can then be integrated into the Counterparty token which is created, and there can never, ever be a question of ownership.

“Ownership and viewability when it comes to digital art are two separate things. Ownership is who legally owns a particular work of digital art. Viewability is who has the ability to see it. Programmers can limit viewability with some tricks, but completely preventing people from sharing digital art is close to impossible. That doesn’t mean the underlying work has no value or that people won’t spend money to own it.

Of course, ownership and viewability are two different things when it comes to digital art. All certified Rare Pepes can be viewed on the Rare Pepe directory, and any internet user can easily download these images to whichever device they may be using. Using Counterparty tokens as easily transferable certificates of authenticity, a programmer or artist has no reason to limit viewability. In this fashion, completely preventing people from sharing ownership IS impossible. If you don’t own the private keys which control the address where the token is assigned, you don’t own the art. This method detracts individuals from implying that there is value in just the art, but rather that there is value in ownership of both the digital art and token. People won’t spend money to own an image file which can be shared or viewed easily, but they will certainly pay for ownership of a token generated by the artist which provably shows they are the owner of that piece of art. People can, will and already have spent considerable amounts of money on Rare Pepes via Counterparty tokens on the DEX (or even via OTC sales).

“In short, yes, it is possible to have a rare Pepe that is actually worth money. You’d want for the original work to be sold on a platform that recorded the buyer and allowed for future transactions of that digital work (e.g., via trade or resale). You would want to authenticate the work was original and ideally the artist would be the one selling the work. You would have to be OK with assuming the image would be shared more widely. But still, just like software or physical goods there would be one or more owners, depending on the number of authentic, original prints sold, and they would have a finite scarcity corresponding to some monetary value, which is determined by the market demand for that print.”

Finally, a statement from someone that understands basic economics and supply/demand. Does this person have a time machine to look into the future? Because oh, wait… this is real life now.

“Selling memes, GIFs, and other internet-based material is complicated and at this point frankly next to nonexistent because if the work itself belongs and functions exclusively online; it is counter to its nature to have it removed from that ‘habitat’. And if you do not, what exactly does the ownership mean?

We don’t blame Magdalena for being so oblivious with the statement she made. Rare Pepes and Counterparty still exist in one of the most remote corners of the internet. But hey, all of these problems have been solved.

At this point, most readers probably think that this is at the very least unconventional, or maybe even a joke. It isn’t. The Rare Pepe community takes their Pepes and the project very seriously, and community led contributions have come from far and wide to enhance the Rare Pepe experience.

A directory of all expert approved Rare Pepes can be found on the Rare Pepe Directory – http://rarepepedirectory.com/

There are fraudulent Rare Pepes, imitations and tokens which are named to mimic actual Rares. If a Pepe isn’t listed on the directory, it isn’t certified rare.

There are rules which must be strictly adhered to when creating and submitting a new Rare Pepe for approval. Those rules can be found on the directory, but are listed below as well.

Rules:

1) Pepe’s must be 400 x 560. They can look like trading cards but it is not required.

2) Cards can be animated gif’s but try to keep them to 1mb or less in size. Use Compression.

2) Issuance must be locked so your Pepe cannot be inflated.3) Your Pepe must not be divisible.

4) Make sure your artwork at least has something to do with Pepe.

5) No NSFW content please.

6) When making your token it must have at least 100 shares.Submissions must be ORIGINAL. Our rareness quality team examines each Pepe for rareness. (no stealing!) If you have been caught stealing someone elses rare Pepe your submission fee will be sent to burn address, never to be recovered.

Our experts understand that lots of Pepe’s borrow from each other to an extent, but try to ad as much Original content as possible… be creative!

Storing your Rare Pepes in Counterwallet is perfectly secure, and if you’re a regular XCP user you can manage all of your Counterparty assets from Counterwallet. If you would like to keep your Rare Pepes safely housed in their native environment so they feel at home, yes… there is a Rare Pepe wallet as well – https://rarepepewallet.com/

Here’s what your Pepes will look like in the wallet once you begin to accumulate –

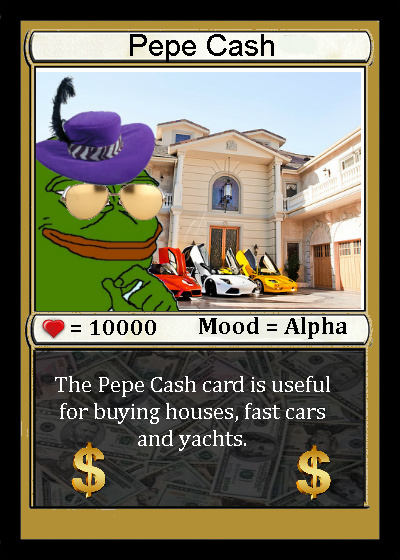

What would a world of Rare Pepes be without it’s own blockchain based currency? No worries, the community has that problem solved as well. PEPECASH is the currency of Pepes, and can be used to pay for new submissions, to speculate with or to be used in p2p transactions. With the token locked at 1 billion shares of PEPECASH, it lacks the inflationary aspect of a currency like dogecoin, while still maintaining the same meme friendly madness. Just over 30% of all PEPECASH has been burned, increasing the scarcity of this asset.

Still think that we’re absolutely bat shit crazy? We might be, but the Rare Pepe fomo is real. There’s no better place to see this for yourself, or even take part, via one of the Rare Pepe auctions. The auctions take place in real time via the Telegram group, and bidders go full degen at times to get their hands on the rarest of Pepes. Even though crypto is the wild west, Rare Pepe auctions adhere to a strict set of guidelines in order to ensure the process runs smoothly.

Details on the next auction, which is Monday, and auction rules are below –

**RAREPEPE BLOCKCHAIN CARDS AUCTION**

MONDAY 6PM ESTPM me to submit your RAREPEPE for auction

Link to directory

Amount

Lowest Price that you want to sell forBuyer/Seller Rules

Auctioneer/Escrow takes 20% of final sale for service fee

Payment for Sold RAREPEPE is made to seller minus fees

Card will be held in escrow until auction is over

All payments must be made within 24 hours***AUCTION RULES***

-ALL AUCTIONS ARE IN XCP , DO NOT ASK IF YOU CAN PAY IN RAREPEPECOIN OR OTHER SHITCOINS!

-Auction Increments are as follows 1-5 XCP Min Increment 0.1 5-10 Min increment 0.5 XCP

10 and above min increment 1 XCP

-please keep chat noise down, we will have plenty of time to chat after

-if you would like to have your rarepepe auctioned please send the auctioneer a pm

with this info: assetname, link to directory, amount to auction, start price

-all sales are final and as is, please inspect the RAREPEPE BLOCKCHAIN CARDS before bidding

-all sales will be handled via PM after the auction is finished, payment due in 24 hours or less

-After: Going Once, Twice, Three times , SOLD the auction is over

If there is a bid then it starts over and we are at “Going Once”

-ALL SALES ARE FINAL, INSPECT THE ITEMS AT YOUR OWN RISK

***

Theo, who is the auctioneer of the events mentioned above, recently took part in an episode of Coin Interview to discuss the Rare Pepe craze.

If you tune in to around the 49 minute mark, Theo is presented with the statement/question – “…it’s not uniquely associated with the image. For one of these images, you could just as easily replace it with a different image and leave the token totally the same… If on this image, you change this image to a different image and don’t touch the token at all, everything is the same. Except now the token is representing this image instead of that other image… Is the image actually coded in the blockchain though?”

Would you be surprised if we told you, the Rare Pepe community has developed solutions to this as well? So far, two unique methods have been used to preserve the association between a Rare Pepe token and the image of the card it represents.

Method 1 – JSON in the enhanced asset information

This is outlined in the Counterparty documentation.

Enhanced Asset Info

When initially setting or changing your asset’s (token’s) description, you can enable enhanced functionality (such as an token image and a longer description) by providing a URL to a specially formatted .json file (e.g. http://www.mydomain.com/foo.json) as the description. This allows the token owner to provide enhanced information to the token’s holders, and enhances the user experience for these holders for wallet implementations that support this spec.

Although this method is reliable, it is dependent on the URL where the .json file is stored being up and easily accessible in the future.

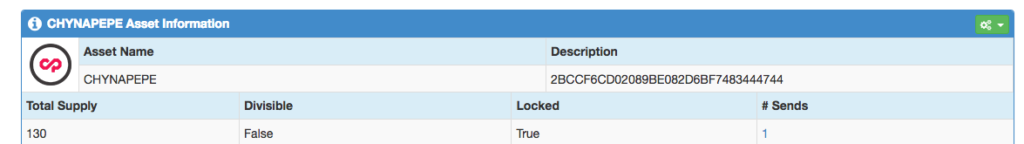

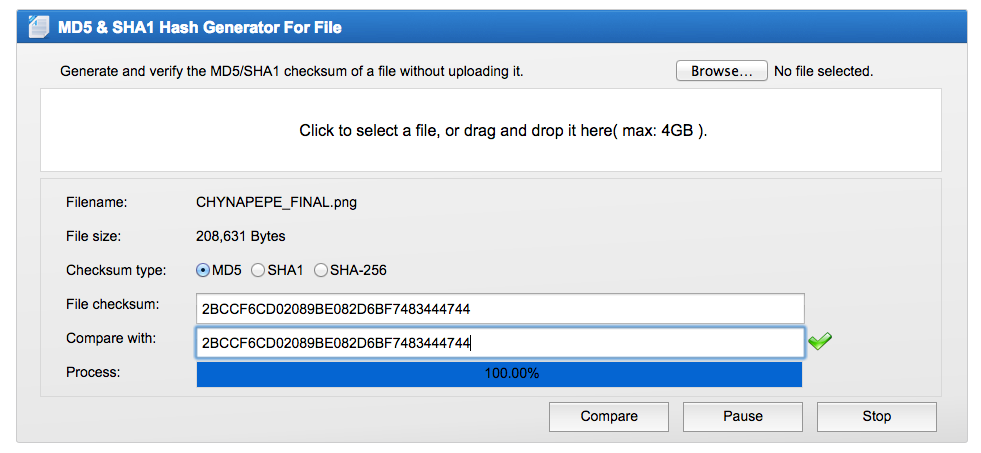

Method 2 – Generate a hash of the original card image, and include that hash in the token information

This method was recently implemented for the first time, in a card named CHYNAPEPE.

The card artist generated a md5 hash of the completed card image, and included that hash in the description field of the Counterparty asset. This hash can easily be viewed by anyone, using a Counterparty block explorer, and used to verify the authenticity of their CHYNAPEPE.

A file checksum can easily be generated by readily available online tools, and that checksum can be compared to the value associated with the Counterparty token.

Using this method, any card can be verified as authentic in the future, even if the Rare Pepe directory or sites where .json files are stored somehow disappear. This method is very similar to the way that software packages are verified today, in order to ensure they aren’t tampered with.

Using this method, any card can be verified as authentic in the future, even if the Rare Pepe directory or sites where .json files are stored somehow disappear. This method is very similar to the way that software packages are verified today, in order to ensure they aren’t tampered with.

Tying this in to the Buzzfeed article mentioned above. Digital artists, and art buyers, now have a way to guarantee scarcity and authenticity of any works. The Counterparty token system also provides a secure way to transfer ownership, without the use of a trusted third party (unless you consider a decentralized exchange to be a third party) or escrow service. In addition, the history of every token can be tracked through the blockchain, allowing the owner to track the history of their art.

What are the implications of this moving forward?

Just like bitcoin, blockchain based Rare Pepes are just an experiment at this point. So far, this experiment has not only proven that digital art can be successfully associated with a digital, blockchain based token, but it has also shown that there is a thriving market for these tokens. Just as bitcoin was laughed at, challenged and finally is becoming accepted, we expect the use of blockchain based tokens to represent both digital and physical art to become much more prevalent in the coming years.

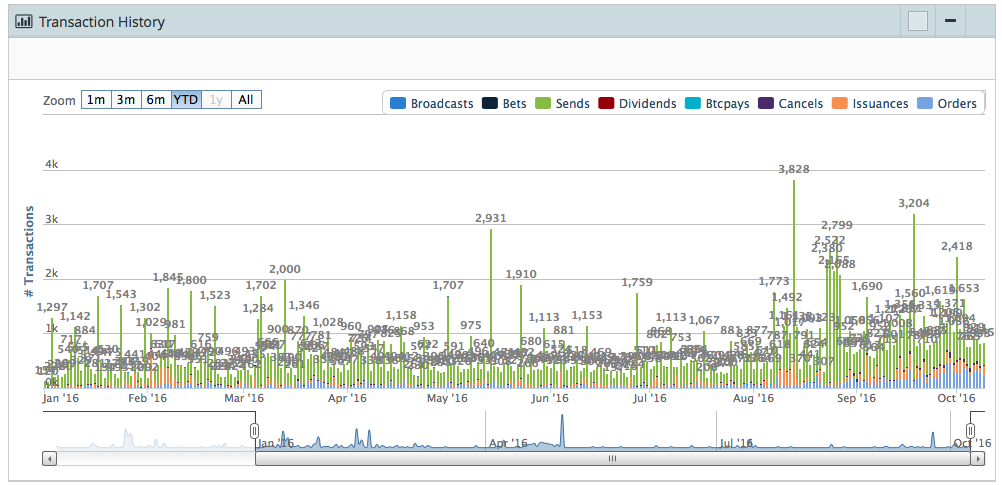

The chart below shows year to date metrics on transactions taking place on the Counterparty protocol. Although there are many other assets which exist besides Rare Pepes, it is clear that asset issuances and orders on the DEX have been steadily increasing year to date. To be clear, this is not the result of just Rare Pepe, but displays the overall increasing acceptance and usage of the Counterparty protocol, and issuance/trading of blockchain based tokens in general.

In Conclusion –

A shitcoin pump and dump is always a lot of fun for fast paced trading, quick gains and to satisfy that degenerate gambler itch. With a plethora of pre-mined scam coins which have an inherent counterparty risk associated with dependence on their own mining networks, individuals often overlook trades/investments/speculation which are backed by more solid fundamentals. Most traders/investors do not factor exchange risk into their investment thesis, which can be detrimental as evidenced by the BFX hack and subsequent haircut. If you don’t hold it, you don’t own it. Luckily the innovations cryptocurrency has facilitated, allow anyone to hold an increasing number of assets, just by owning the private keys.

Hidden somewhere in this post is a Rare Pepe. Good luck on your quest.

Disclaimer: This is not investment advice, and we don’t give a fuck what you do with your money. There are only going to be 21 million bitcoins ever produced, and we’re all in a race to collect as many as possible. If you want to “invest” in some shitcoin pump and dump on a questionable exchange, be our guest. We’re holders of a bunch of different Rare Pepe cards, and will probably be the ones selling to you much higher once price discovery kicks in.