Almost exactly seven years after the 2008 financial crisis, it appears as if the world’s current financial system is on the brink of outright collapse once again. If you are reading this blog, you probably aren’t oblivious to the recent fx volatility, emerging market bloodbath and constant dewm narrative now being pushed by the msm. With a possible fed rate hike (or maybe even QE4eva) looming in just a few hours from now, general tension and unease can be felt globally as investors struggle to position themselves for the coming weeks and months. A rate hike is likely to trigger a market collapse, while moar QE will pretty much give the fed and its funny money absolutely no credibility.

While most people’s retirement accounts and home value were rekt in 2008, there are some identifiable positives which came out of the crisis. Three we often contemplate are:

- Interest in financial education by the general public

- Zerohedge

- Bitcoin

One of the largest (possibly) unintended consequences of the crisis was the desire of the general public’s attempt to become more “financially savvy”, or at the very least learn why their net worth was more rekt than an OKC margin call cascade. Since the collapse of the dot-com bubble, high speed internet and smartphones have spread like wildfire and large amounts of information is readily available to anyone who seeks it. Sure, most folks nearing retirement age still can’t accurately tell you what QE is; but generally, more of the public and world at large began to educate themselves about the absolute mess that our current financial system has become.

A huge contributor to this education effort is Zerohedge (and other alt-media sites), which has proven itself to be more on point than the msm. Mom and dad probably don’t read ZH, but those who decided to dive down Alice’s rabbit hole are probably regular readers. While some articles are pure fluff, and others may contain inaccuracies, some of the most valuable information is often found in the snarky comments where these issues are debated and sorted out. A little Google-fu (can we change this to DuckDuckGo-fu now?) of your own, and you feel like – “A whole new world!”.

For those of us who are really out there (I guess), we stumbled upon (great app btw) bitcoin, which probably expanded that initial and once so vast rabbit hole into the Kingdom of Narnia. Many sleepless nights later and epiphanies later, it’s likely that your views of the world and finance have been turned upside down.

Why will bitcoin matter in the upcoming financial crisis?

Obviously, each community member has their own views on this topic. How though, can this information be conveyed to Mom and Dad at the most basic level? In essence, each of us hodlers is front running the crash, while newly enlightened and “financially savvy” Joe Public is still fucking around with inverse ETFs and volatility options trying to time the next crash and “retire”. Sorry to “bust your bubble”, but good luck retiring with that stack of worthless fiat if you can even cash out once the fire exits are locked. If you are the type of person who quietly chuckles to yourself at cocktail parties while listening to “savvy” individuals talk about the market while you are compulsively checking ZeroBlock, you probably already know this though.

Americans have long enjoyed the privilege of having the world’s reserve currency as their national currency. Because of this, they have never faced or had to live through a currency crisis, as many nations around the world have in recent decades. Citizens of some other countries whose currencies are pegged to the dollar have thus been transferred this privilege as well, and are subsequently also living in oblivion. On the other hand, some countries such as Panama and Ecuador go as far as using a process known as dollarization, making the USD their official national currency. Most individuals fail to consider that many (but decreasing in number) securities and financial instruments are USD denominated, meaning that traders/investors need to hold USD to buy them and are given USD when they are sold. As the USD faces ever increasing competition from both other fiat currencies and digital currencies (cryptocurrencies included), where are these parked USD going to move? Obviously, things are much more complicated than this and many other factors come into play; but when the shit starts to hit the fan, where will all this money move?

Because of the status of their national currency as the worlds reserve currency, Americans do not fundamentally understand inflation the way most emerging nations do. To most Americans, inflation is only a measure of how much more their beer and hamburger cost y/y July 4th BBQ. They do not understand how the value of their currency will behave vs superior forms of money, especially when fiat currency is overtaken by a superior form of money in a so called “speculative attack”. More on this speculative attack in a bit, but for now, let’s introduce readers to Gresham’s Law:

Gresham’s law is an economic principle that states: “When a government overvalues one type of money and undervalues another, the undervalued money will leave the country or disappear from circulation into hoards, while the overvalued money will flood into circulation.”[1] It is commonly stated as: “Bad money drives out good”.

This law applies specifically when there are two forms of commodity money in circulation which are required by legal-tender laws to be accepted as having similar face values for economic transactions. The artificially overvalued money tends to drive an artificially undervalued money out of circulation[2] and is a consequence of price control.

Gresham’s law states that any circulating currency consisting of both “good” and “bad” money (both forms required to be accepted at equal value under legal tender law) quickly becomes dominated by the “bad” money. (For a formal model see Bernholz and Gersbach 1992). This is because people spending money will hand over the “bad” coins rather than the “good” ones, keeping the “good” ones for themselves. Legal tender laws act as a form of price control. In such a case, the artificially overvalued money is preferred in exchange, because people prefer to save rather than exchange the artificially demoted one (which they actually value higher).

Gresham’s Law was developed during a time when physical coinage was most prevalent. With the advent of digital currencies though, what if this law was extrapolated to include the digital space? Could sound money such as bitcoin be viewed as “good money”, while freely printed fiat paper promises start to become recognized as “bad money”? Believe it or not, for many of us, this has already happened.

The first part of understanding how bitcoin will fit into this mess is understanding why the upcoming financial crisis is going to be different than the rest. Sure, we have the 630+ trillion derivatives bubble, frothy stocks and real estate, COMEX registered gold at a record low and many other hazards to navigate, but what many normies fail to consider is the stability of the actual currencies that everything in the world that they know is priced in. With headlines like Fed Enters Rate Hike Meeting With First Headline Deflation Since January being pumped by the usual msm culprits, we can completely understand how Mom and Dad are left scratching their heads, not understanding what the fuck is going on. A few weeks ago we’re worried about inflation, now we’re worried about deflation? After enough of this, the only inflating you want to know about is that of your stomach, with alcohol. Maybe that’s the point actually. To confuse the shit out of Joe Public so that he would rather not pay attention because it makes no sense.

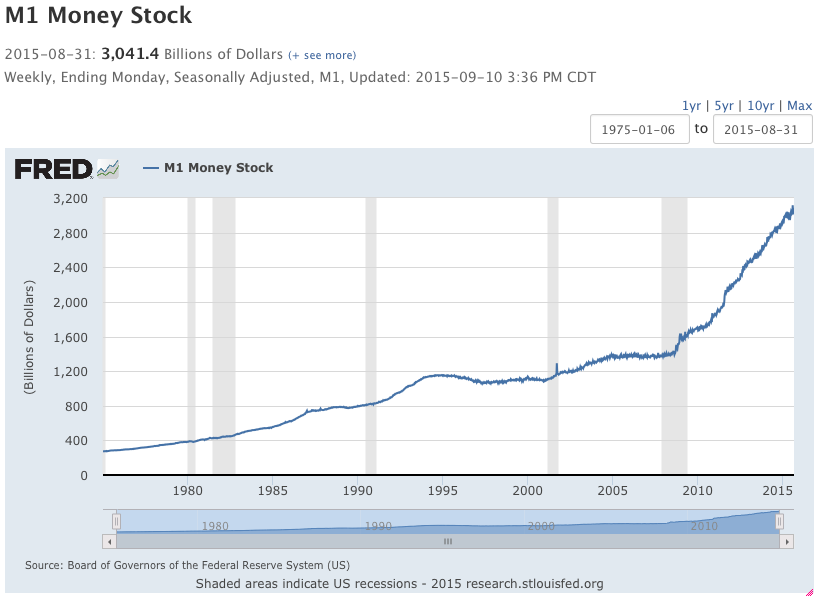

Regardless of inflation or deflation, we believe one important statistic to look at is the increase in money supply over time is through the M1 and M2 Money Stock Measures, presented by the St. Louis Fed.

First we will take a look at M1

What is M1 a measure of? From Investopedia:

A measure of the money supply that includes all physical money, such as coins and currency, as well as demand deposits, checking accounts and Negotiable Order of Withdrawal (NOW) accounts. M1 measures the most liquid components of the money supply, as it contains cash and assets that can quickly be converted to currency. It does not contain “near money” or “near, near money” as M2 and M3 do.

As is clearly illustrated, M1 is currently 3,041.4 Billion USD. Shaded areas represent US recessions. See that hockey stick looking thing on the right hand side? The M1 measure has nearly doubled since the 2008 financial crisis. Doubled, in 7 years.

As is clearly illustrated, M1 is currently 3,041.4 Billion USD. Shaded areas represent US recessions. See that hockey stick looking thing on the right hand side? The M1 measure has nearly doubled since the 2008 financial crisis. Doubled, in 7 years.

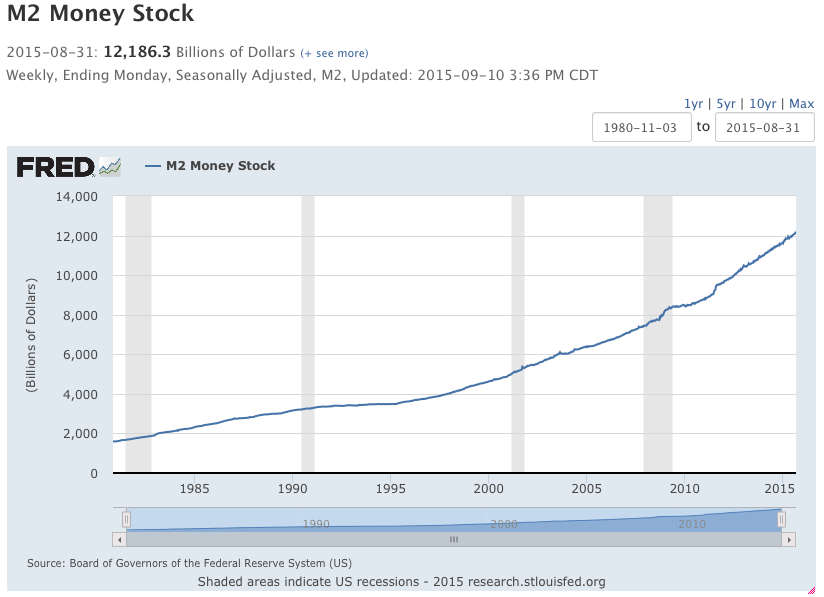

For a more detailed look into money supply, let’s take a look at M2.

What is M2? From Investopedia:

A measure of money supply that includes cash and checking deposits (M1) as well as near money. “Near money” in M2 includes savings deposits, money market mutual funds and other time deposits, which are less liquid and not as suitable as exchange mediums but can be quickly converted into cash or checking deposits.

M2 hasn’t hockey sticked quite like M1 has, but the pace has clearly picked up in recent years. The take away from looking at M2 is noticing that this figure includes savings deposits and money market mutual funds. That’s over 9,000 Billion USD, of “near money” that may need to seek shelter somewhere, at some point soon.

M2 hasn’t hockey sticked quite like M1 has, but the pace has clearly picked up in recent years. The take away from looking at M2 is noticing that this figure includes savings deposits and money market mutual funds. That’s over 9,000 Billion USD, of “near money” that may need to seek shelter somewhere, at some point soon.

The argument can be made that an increase in money supply does not equal inflation in the price of goods and services. While this can be true in the short term, this is not the point that we are attempting to illustrate. As we will discuss later, rapid inflation is likely to come only when fiat currencies undergo a speculative attack by a superior form of money, at a later date. All that readers should take away from the figures above is the dramatic increase in M1 over the last seven years, and the large amount of near money that comprises M2. Specifically, keep in mind that this near money includes savings and money market accounts.

During times of financial crises, money tends to seek shelter in safe haven investments. The history of crises will show us that these safe havens often include precious metals, fiat denominated bonds, physical cash (fiat), “cash” money market accounts, put options priced in fiat and a variety of other “vanilla” investments. Joe “Savvy” (after 2008) is likely to take a more aggressive stance, positioning himself short, going long the VIX and using insane leverage against central banks virtually unlimited supply of fiat. The common thread tying most safe haven investments together is that unless they are something physical, most are worthless fiat paper promises or a bunch of fiat 1s and 0s inside a computer. Most people fail to realize that in an ever evolving world, their fiat will one day be worthless, and that day is probably sooner than they think.

The past shows us that “cash” is often considered by most to be a safe haven during economic downturns. Years of investing experience have shown the normies that if they time the cycles right and BTFD, fiat riches are to be made. Again, this is an extreme over simplification of markets, but the goal is to get Mom and Dad to understand why this time actually is different. The easiest route for most normal investors or traders to take is to buy low, sell high. Rinse, repeat. This same behavior can be exhibited in retirement accounts, as folks attempt to prepare for possible economic downturn. Have you ever looked at what “cash” in your trading or retirement account actually is though? Chances are, you are actually investing that “cash” into a money market account with your broker. Again, we will get into this in more detail later.

After every boom, comes a bust, and it’s only a matter of time until the US stock markets are in full meltdown mode again. We aren’t in the business of making predictions of when this will happen, but at some point everyone will rush for the exits at once. Given the msm’s recent coverage, we’re sure it will be blamed on HFT, hacking or something else of the sort.

What makes this time different is the fact that society has been given an alternate safe haven in which to safely store their wealth and transact. With many advantages over both fiat currency and precious metals, the performance of cryptocurrencies (bitcoin is the largest) has not yet been tested in the face of financial collapse or economic downturn. Bitcoin was conveniently released during the depths of the last crisis, quietly suggesting “problems solved”. For the first time since it’s invention, fiat has a formidable opponent.

From the Chicago University Law School paper that we refer to later in this post:

For a bit more detail, view the video below:

For a bit more detail, view the video below:

If bitcoin hasn’t proven it’s performance in the face of a financial crisis, what do we think it’s role will be?

As events in Cyprus and Greece have shown us, capital controls are no joke and often appear simultaneously as a crisis occurs. In the real world, life and business must go on, and forward thinking individuals are likely to use bitcoin as a means of conducting exchange in an environment that may not permit so otherwise. Our friends at BitMEX recently outlined the role that bitcoin could play for the Chinese, as the government actually begins enforcing capital controls.

As we saw in Greece, domestic transfers were not impacted by capital controls, and luckily Circle and Coinbase offer a great ACH service to US based customers if they should experience such an event. Similar exchanges exist in most countries globally. The prevalence of trusted exchanges in most economies provides a quick and easy on/off ramp for those wishing to convert bitcoin into their national fiat trash cash. If international capital controls are implemented in the current financial system, individuals could simply purchase bitcoin on their local exchange to send abroad, hassle free. The receiver could convert that bitcoin into their local currency if they wish, or leave it in their digital wallet for later use.

At the very least, should the speculative attack against fiat currencies be mitigated, bitcoin will provide a seamless method of exchange for international business to be conducted in the face of capital controls. Who wants to mail precious metals or cash to buy something from a vendor when they can scan a qr code from their smartphone?

The role of bitcoin during a financial crisis is not limited to just circumventing capital controls though. This is just one example which can be illustrated by recent news events that Joe Public can relate to. In our view, the biggest advantage of bitcoin over fiat which can be realized by the ordinary person is going to be it’s use as sound money/a store of value over the longer term. In turn, leading to the behavior recognized by Gresham’s Law.

What is this speculative attack that we keep speaking of?

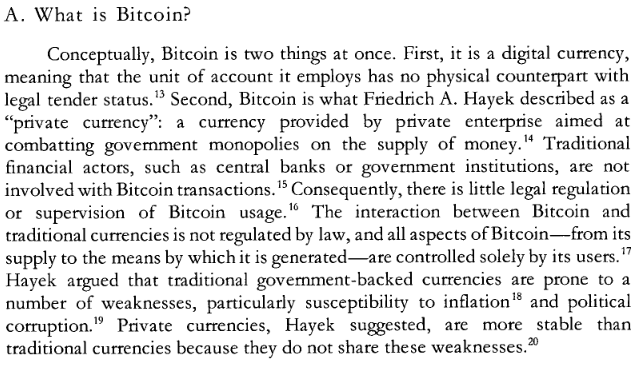

The scenario of a speculative attack against fiat currencies, and the potential relevance of this phenomenon to the IMF is outlined in this University of Chicago Law School paper:

Now it might be easier for Mom, Dad and Joe Public to put the pieces together – Gresham’s Law, Bitcoin and a speculative attack against fiat currencies? Although anything can spark inflation, the most likely scenario is that a sudden distrust in fiat money will send a sudden wave of investors seeking shelter in safer assets. In such a scenario, we would expect the “bad money” to begin to hit the streets, as the “good money” (including bitcoin) is hoarded. This sudden increase in the supply of “bad money” is the most likely driver which will cause inflation, as the masses realize they have a choice. As we have seen time and time again, individuals without access to or knowledge of precious metals and bitcoin directly, will likely seek physical assets, in hopes that they will retain more value than their fiat or can be traded for sound money/currency at a later time.

Although covered in the video above, let’s revisit the three functions of currency, and how they relate to bitcoin.

From the same Chicago Law paper:

Bringing this back to the M1 figure illustrated above, we ask the question. When faith is lost in fiat currency, where is all of that money going to go? We see bitcoin as being a prime candidate.

Bringing this back to the M1 figure illustrated above, we ask the question. When faith is lost in fiat currency, where is all of that money going to go? We see bitcoin as being a prime candidate.

As for M2 and the money market accounts. Many “savvy” individuals failed to take notice when the SEC implemented new money market rules a few months ago. MarketWatch outlines some of the changes:

The SEC regulations aim to prevent an investor exodus from money-market funds like the one that happened during the 2008 financial crisis, when the federal government had to step in with financial backing for the industry.

One requirement under the new rules is that the shares of money-market funds that cater to institutional investors and invest in corporate or municipal debt must float in value, like the shares of most other mutual funds. That’s a change from the stable $1-a-share value traditionally maintained by all money-market funds. The idea is that investors will be aware of changes in asset values as they occur and be able to adjust their holdings accordingly, rather than stampeding out of funds when they suddenly become aware that their shares aren’t worth $1.

For a bit more on the subject, feel free to read this paper by the NY Fed. With investors trapped in money market funds which are declining in value, where can we see some of that money going? Our belief is that some of it will move into bitcoin by gaining exposure via any proxy available to investors at the time: GBTC, BTCS, ARKW, etc. Savings are also included in the M2 figure. It is likely that some of those savings will move into bitcoin as well, via the current ACH (or similar domestic) system and Coinbase/Circle (or other competitors globally).

In summary: Financial crises are often triggered by “black swan” events, that few see coming. As much as everyone wants to time the crash, this is not a smart or sustainable investment strategy. Taking a deeper look into post-2008 events, and virtually unlimited money printing by global central banks, it appears as if this time really is different. What makes it different though, is the fact that investors and the general public have a new safe haven asset class where they can retreat (bitcoin). This asset class may be unconventional to some, but to others it is the next logical step in the journey of money through time. The world is about to witness the greatest wealth transfer in history, which side will you be on?

Whether or not Janet decides to raise rates today is left to be seen. If she does though, we are left wondering. Could the real reason be to stave off a speculative attack?

From the Chicago Law paper: