In our last post, we outlined some of the shenanigans that were occurring in the LTC marketplace (specifically on BFX). A week and a half later, both bulls and bears are in tears, after some of the most extreme volatility the LTC market has seen in years. We don’t expect this volatility to die down any time soon (a gift for traders), but we feel that the community at large should have a more thorough understanding of the underlying fundamentals of the price action that we have been seeing.

We have been performing a thorough analysis of the different market forces acting on the LTC (and to a lesser extent BTC) markets over the last few weeks, and are attempting to assemble the pieces so that traders can make an educated decision on what their next trades should be. There is a worrisome element to all of this (outlined in 1, below), and the last thing that the crypto community needs at a time when it is finally going mainstream is more traders/investors to get burned and have disdain for the crypto community because of a malicious actor.

1. The Chinese LTC ponzi (surprising, eh?)

2. Pump Team 6

3. Return of old players

4. New interest in Crypto/media coverage/Greece = new money

5. Irrational exuberance and margin trading

Of what we outlined above, we only consider point 1, the ponzi scheme, to be a malicious actor. The others are viewed as forces in the free market.

More details on each below:

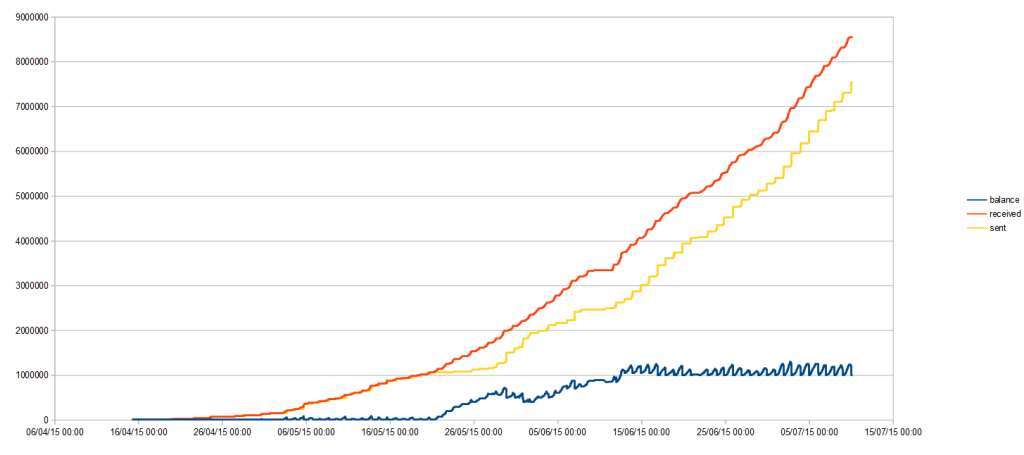

1. The Chinese LTC Ponzi – Our friends over at BitMEX published an excellent blog post two days ago outlining the ongoing LTC ponzi scheme in China. This is the address which is being used for the scheme, it has now received over 8.5 million LTC. Bitcoin Magazine goes a bit more in depth on the scheme, and the statements different exchanges have made in response.

An analysis of the wallet address shows that the deposits and withdraws are still increasing dramatically, so the scheme is still ongoing.

h/t: @Legion for the data, you can view it for yourself here

h/t: @Legion for the data, you can view it for yourself here

As stated in the Bitcoin Magazine article, some of the more customer oriented exchanges have taken steps to mitigate any damage from the ponzi, and have reached out to traders/investors to warn them of the unusual trading activity. Huobi posted the attached.

While we believe that the LTC ponzi group has contributed partially to the dramatic LTC price and volatility explosion, we believe that the other market forces acting in parallel have amplified both the upward and downward moves of LTC, creating a potentially hazardous trading environment for those who are ill-informed.

It is our belief that the LTC ponzi masters are the least sophisticated of the actors involved in the market gyrations.

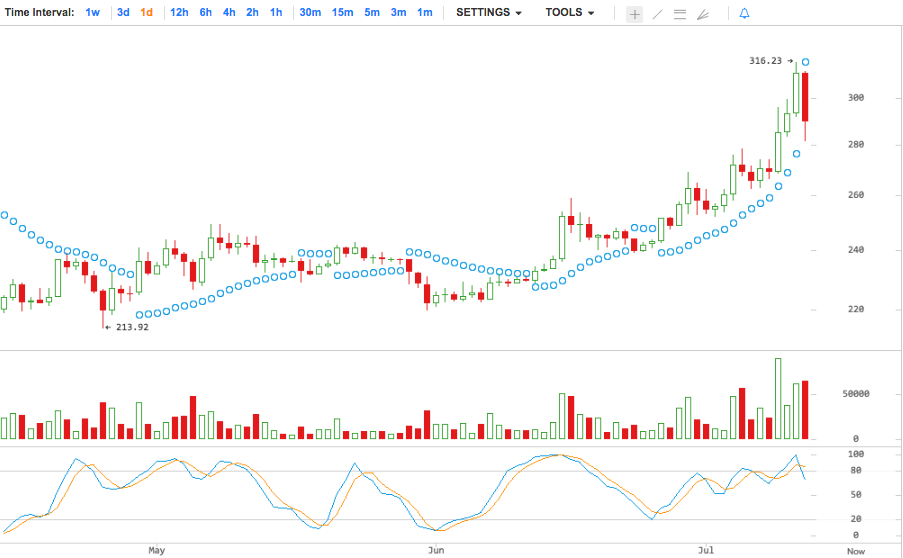

2. Pump Team 6 – Starting on May 22, 2015, it started to become clear that LTC was beginning to undergo a somewhat sophisticated crypto pump. The coin had been beaten down during the bear market, and was primed for some upward movement. Subsequent pumps in PPC and NMC seem to exhibit similar characteristics, which may be a coincidence or may be totally unrelated.

The pump team seems to be extremely sophisticated and precise with their actions, utilizing a variety of strategies across multiple exchanges in order to achieve their goals. It is our belief that the primary goal of the pump team is to accumulate BTC, with USD gains coming secondary.

Between May 22 and July 9, 2015, we saw the btc price (on bfx) rise from $240, to ~$296. This is a roughly 23% increase.

During the same time period, LTC saw a substantially more dramatic rise from $1.50 to ~$8.90, a roughly 493% rise.

During the same time period, LTC saw a substantially more dramatic rise from $1.50 to ~$8.90, a roughly 493% rise.

Traders have been talking about the “decoupling” of ltc and btc over the last few weeks, but is it coincidence? Our take is, no. Watching the market action over the last few weeks during the ltc pump, it became clear that an actor was cashing out cheap ltc that they had purchased for btc, with 1k – 5k ask walls on ltc/btc strategically placed the entire way up. Similar size ask walls were chewed through on ltc/usd, providing some small breathers in the bull market. At the same time, iceberg btc asks were being thrown on okc and hidden btc asks on bfx during periods of significant upward ltc price movement.

Traders have been talking about the “decoupling” of ltc and btc over the last few weeks, but is it coincidence? Our take is, no. Watching the market action over the last few weeks during the ltc pump, it became clear that an actor was cashing out cheap ltc that they had purchased for btc, with 1k – 5k ask walls on ltc/btc strategically placed the entire way up. Similar size ask walls were chewed through on ltc/usd, providing some small breathers in the bull market. At the same time, iceberg btc asks were being thrown on okc and hidden btc asks on bfx during periods of significant upward ltc price movement.

What would the purpose of this be? If the pump team was able to successfully hold down the bitcoin market while pumping ltc, their btc earnings from the pump (via the ltc/btc pair) would be significantly greater than if btc were to pump at a somewhat steady rate during the same time period. One advantage of using leverage and/or futures to suppress the bitcoin market is that a player can have a significant impact with a small number of coins (this is why market manipulation in most markets ie: precious metals, is through futures). As long as the number of coins the pump team was accumulating through their ltc pump and subsequent ltc/btc sells was significantly more than what they were throwing at the market, it would be worth their while to perform this tactic even if their “shorts” were to be margin called later.

Around the time of OKC futures settlement last week, the speed of the ltc pump began to die down, and traders started to wonder when it would end. News of the Chinese ponzi was leaking out, and mysteriously, exchanges began to be DDOSed. It was clear that the pump team had made their exit, and margin traders high on hopeium started to sober up to reality, and realize that they were going to be fucked when they couldn’t close their FOMO long in time to escape.

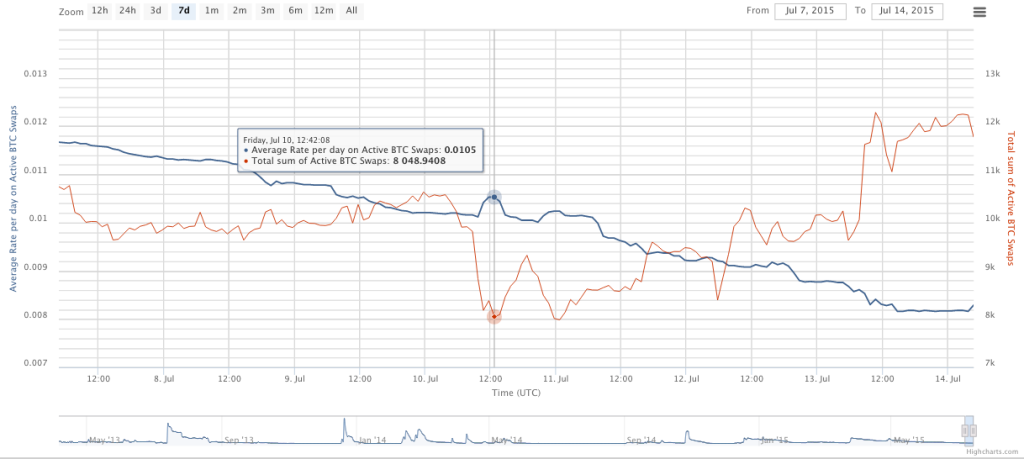

As we believe that it was the ultimate goal of Pump Team 6 to acquire as many btc as possible, this is where we believe the second part of their plan came into play. Like we saw with their earlier ltc actions (reserving all swaps then pumping), these guys are experts. It is our belief, that at this time, they begun closing all of their btc “shorts”, while simultaneously pumping btc with the usd that they had earned during the ltc pump. You can see a large number of shorts which were closed at the time.

This generated a large amount of btc buy volume across all exchanges, which coincided with DDOS attacks and the situation we are all too familiar with regarding OKC’s margin calls.

This generated a large amount of btc buy volume across all exchanges, which coincided with DDOS attacks and the situation we are all too familiar with regarding OKC’s margin calls.

Our question is, did someone else realize what the pump team was up to, understand that they may be in a position to incur massive losses, and orchestrate some events in an attempt to mitigate getting rekt? New money is clearing coming into bfx, which has been leading the market as shady Chinese exchanges fade into obscurity. As victims (oops, we mean “traders”) migrate to other platforms, what lengths might actors in the bitcoin eco-system go to in order to attempt to save themselves?

These questions may go unanswered for the time being, but as more information leaks in, it is beginning to seem as if some of the tin foil theories might not be too far off.

3. Return of old players – There has been a recent return of old players to the crypto community. Fontas is a regular on tv, and his return alone has hyped traders up enough to jump on the ltc bandwagon. While we feel that this impact may be minimum, it is important to note because there definitely has been a buzz around buying when he is present. Maybe this is just the newbs that weren’t around for his first rodeo, but either way this element can’t be ignored.

4. New interest in crypto/media coverage – This one should be obvious. Check out /r/bitcoin any day and you will see coverage by every major news media outlet. The situation in Greece, possible bail-ins and the msm pushing bitcoin have definitely had an impact on the market place. How much new money is actually flowing in? This is difficult to tell, but we suspect it isn’t a large sum at this time. As the bull market continues, we expect to see more new money flow in, and geo-political/financial events can always have a sudden positive impact in the amount of money flowing into crypto.

5. Irrational exuberance and margin trading – As with any mania, tears are shed by those left holding bags when we get a 404 buyers not found error. Combine the ease of margin trading in the crypto space with inexperienced traders and you have a recipe for disaster. Many got rekt buying the top, and hopefully will not be turned off to crypto forever from the experience.

So, where do we go from here? What should we expect?

The Chinese LTC ponzi doesn’t seem to have slowed down, but we question what their end game is. All ponzi’s must collapse some time, but what is their proposed exit strategy? Were they screwed when everything collapsed? Did they realize that LTC was being pumped at the same time by other actors? The continuation of transactions to their wallet suggests the scheme is ongoing, but the price action in the market place (specifically on exchanges which made statements regarding the ponzi) seems to show that they are struggling with their own scare walls, and less dynamic forces acting on the market.

We saw the ltc price continue to dip after the initial shock, suggesting that many traders cut their losses, but how many?

We expect there to be some pretty massive overhead pressure on ltc for the time being, but don’t discount the possibility of a move up as btc continues to gain traction. Our suggestion to new traders is to play the ltc/btc pair, unleveraged for the time being, in order to take advantage of price movement in the market place. For more experienced traders, play the markets as you normally would, but be cautions of the potential forces you may be dealing with. Although we all love making money off of that guy who buys our asks on the ponzi spike, the overall health of the crypto community is more important than making a few dollars. Every trader that is turned off to the space after being absolutely obliterated, is one less player in our daily game of stealing each others money. While we don’t suspect that the pump team planned on this collapsing as hard as it did, we wonder exactly who else knew what was going on? These questions should be answered in the coming days, as more information comes in regarding the “Mouse Group” and how OKC is going to end up settling with their customers. So far, as is clear on Reddit, everyone is getting shafted.

We expect there to be some pretty massive overhead pressure on ltc for the time being, but don’t discount the possibility of a move up as btc continues to gain traction. Our suggestion to new traders is to play the ltc/btc pair, unleveraged for the time being, in order to take advantage of price movement in the market place. For more experienced traders, play the markets as you normally would, but be cautions of the potential forces you may be dealing with. Although we all love making money off of that guy who buys our asks on the ponzi spike, the overall health of the crypto community is more important than making a few dollars. Every trader that is turned off to the space after being absolutely obliterated, is one less player in our daily game of stealing each others money. While we don’t suspect that the pump team planned on this collapsing as hard as it did, we wonder exactly who else knew what was going on? These questions should be answered in the coming days, as more information comes in regarding the “Mouse Group” and how OKC is going to end up settling with their customers. So far, as is clear on Reddit, everyone is getting shafted.

We believe a group called Mouse is to blame for yesterday and today's DDOS attacks on @OKCoinBTC Emails are attached. pic.twitter.com/Ghd3ImuFZ5

— OKCoin (@OKCoinBTC) July 13, 2015