A running joke amongst Bitcoin traders is that “we just draw lines and steal each others money all day”. Sadly, this isn’t far from the truth, but there is one important piece that most people miss out on. “We” aren’t just stealing each others money, but the market makers are constantly taking money from traders and exchanges are pulling in transaction fees like a going out of business sale.

Sure, some say that if you stare at the charts long enough you will see pretty much anything, but we think that there has been a little bit more going on behind the scenes.

For a brief introduction, we recommend reading this very well put together blog post by BTCVIX.

We recently discussed the migration of bitcoin traders to alternate markets. Because of the higher fees on BitFinex relative to the Chinese exchanges, the liquidity on BFX during these slow, ranging days has dried up worse than California’s water resources. It’s almost as if traders have given up, and don’t care about participating in a marketplace that is being raped by the market makers.

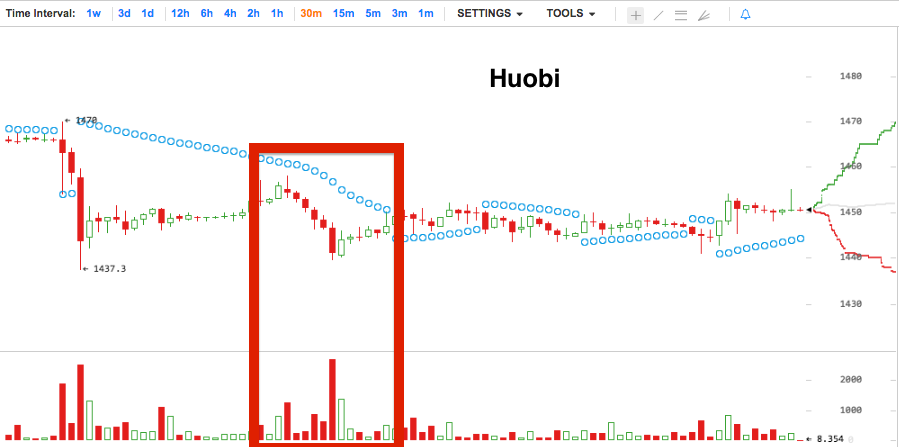

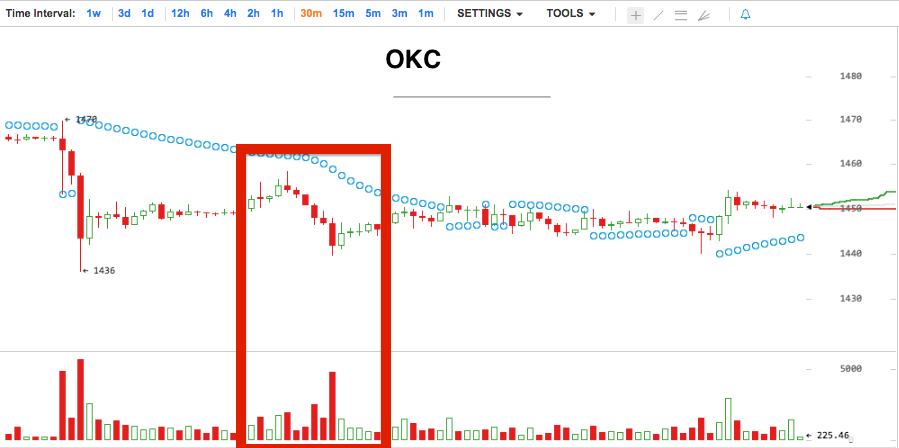

This looks evident if we analyze yesterday morning’s sell off (pay attention to volume).

The lack of volume on BFX during the sell off leads us to believe that there were few active participants at that time, including stop and limit orders on the exchange. This is very strange, considering the usual cross exchange volume correlation.

The lack of volume on BFX during the sell off leads us to believe that there were few active participants at that time, including stop and limit orders on the exchange. This is very strange, considering the usual cross exchange volume correlation.

If you trade on BFX, and stare at their charts all day every day, you will recognize this shape in the visual representation of their order book (showing bid/ask depth). It won’t fucking go away, except for when there are sizable market pumps or dumps. Even when the market moves a small amount, liquidity near bid/ask becomes non-existent these days.

While it is possible that these are many different people’s bots adjusting to market fluctuations, it seems more likely that this is one market maker. By controlling most of the order book near the bid/ask, it would be incredibly easy for a market maker to deduce which orders belonged to other traders, simply by process of elimination. This would certainly give them an edge over others.

We aren’t saying that this is definitely the case, but coupled with the article from BTCVIX it seems like a reasonable explanation that would explain recent market behavior. We trade on BFX, love them, and think that they have one of the most sophisticated total trading packages (swaps, etc) that is offered to bitcoiners. In no way is this meant to say anything negative about BFX, just offer some insight into the activities of what appear to be a large market maker on the exchange.

Obviously the intention of any market maker is to make money (and markets, we guess). The irony in all of this is that their aggressive market making activities could be discouraging traders, which decreases their profits, and the profits exchanges reap from trading fees. The beauty of this all (if correct, of course), is that we are seeing a free market in work.

Happy trading everyone.